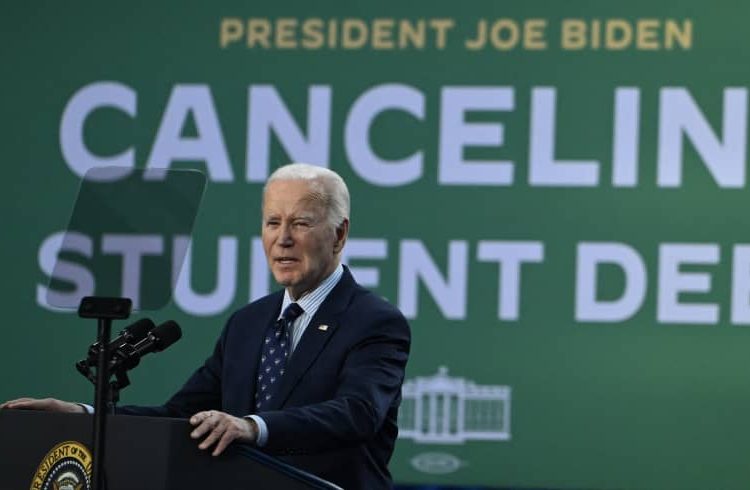

A federal district court judge in Texas has struck down President Biden’s student loan forgiveness initiative, delivering a significant blow to his plan to provide relief for millions of borrowers.

Biden’s program would allow up to 40 million borrowers to receive $10,000 or more in student loan forgiveness if their earnings fell within the program’s income guidelines in either 2020 or 2021. But no borrower has received loan forgiveness under the initiative due to ongoing legal challenges.

What Was Biden’s Student Loan Forgiveness Plan?

Biden’s program aimed to offer up to 40 million borrowers $10,000 or more in student loan forgiveness if their earnings fell within the program’s income guidelines for 2020 or 2021. However, no borrower has received loan forgiveness under this initiative due to ongoing legal challenges.

Court Ruling Deals Serious Blow to Biden’s Plan

A conservative nonprofit organization filed a lawsuit on behalf of two borrowers, arguing that the administration did not follow the proper procedures under the Administrative Procedures Act (APA) to establish new programs and regulations. The Biden administration contended that the HEROES Act of 2003 provided the basis for enacting new emergency regulations without needing to follow APA procedures.

In a significant departure from previous court rulings on this matter, U.S. District Court Judge Mark T. Pittman struck down the program on its merits, not just on procedural grounds. Previous decisions focused on whether the plaintiffs had the standing to sue, requiring a demonstration of a concrete injury linked to the challenged program.

Biden Administration to Appeal the Decision

The Biden administration condemned the court’s ruling and vowed to appeal. U.S. Secretary of Education Miguel Cardona stated, “We are disappointed in the decision of the Texas court to block loan relief moving forward. Amidst efforts to block our debt relief program, we are not standing down. The Department of Justice has appealed today’s decision on our behalf, and we will continue to keep borrowers informed about our efforts to deliver targeted relief.”

White House Press Secretary Karine Jean-Pierre echoed this sentiment, emphasizing the administration’s commitment to helping working and middle-class Americans, despite opposition from what she described as extreme Republican special interests.

The Legal Battle Ahead: Appeals and Challenges

Legal experts have criticized the District Court’s decision, noting the failure to address the issue of standing. The case will now move to the 5th Circuit Court of Appeals, known for its conservative leanings. This court has issued recent rulings suggesting skepticism towards Biden’s student loan forgiveness program.

Should the 5th Circuit uphold the Texas court’s decision, the Biden administration’s next step would be an appeal to the U.S. Supreme Court. However, the Supreme Court is not guaranteed to take up the case or rule in favor of the administration.

Additional Legal Challenges to Biden’s Plan

The latest setback is not the only legal challenge to Biden’s student loan forgiveness plan. In October, the 8th Circuit Court of Appeals blocked the program in response to a separate lawsuit filed by a coalition of Republican-led states. These states argued that the loan forgiveness program was unlawful and would financially harm the states due to reduced revenue from borrowers consolidating their loans to qualify for forgiveness.

A federal district court had dismissed this lawsuit on the basis of standing, but the states appealed to the 8th Circuit, which issued a temporary administrative stay. This stay remains in effect while the court considers a preliminary injunction.

Current Status of the Student Loan Forgiveness Application

As of now, the application for Biden’s student loan forgiveness program is offline. A message on the application website reads, “Student Loan Debt Relief Is Blocked,” reflecting the current legal impasse.

President Biden’s student loan forgiveness plan faces significant legal challenges that have halted its implementation. The administration remains committed to appealing these decisions and providing relief to borrowers, but the path ahead is fraught with legal hurdles and uncertainty. Borrowers are advised to stay informed about ongoing developments in this crucial legal battle.

Comment